Real-time payments, everywhere

We’re building the world’s first global real-time payment network.

Move money at lightning speed, wherever you are.

A GLOBAL SOLUTION

One integration to a world of real-time payments

We give businesses globally the power to receive and send real-time account-to-account payments. Switch on a globally optimised Pay by Bank at checkout. Benefit from a faster, more secure way to handle customer funds.

A HARMONISED SOLUTION

Acting on real-time’s revolutionary potential

Real-time payments are being rolled out globally, but by individual territories. We’re acting on their revolutionary potential by bringing domestic networks together to a single, harmonised solution.

Real time EVERYWHERE

Delivering the future of online payments

Welcome to the future of e-commerce, where funds flow in real time – directly from one bank account to another, across borders and without intermediaries – everywhere.

WHAT WE’RE BUILDING

The first global real-time

payment network

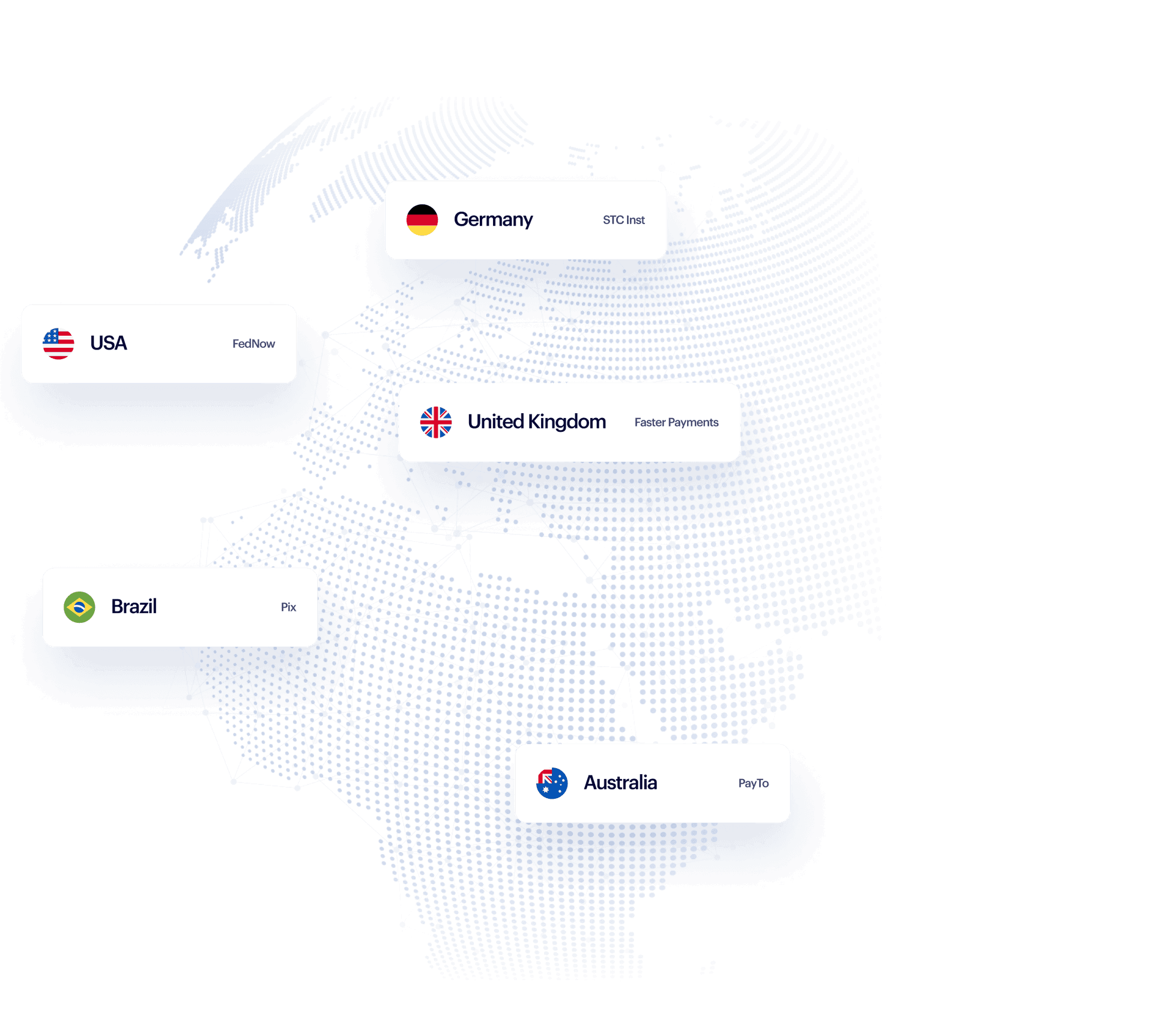

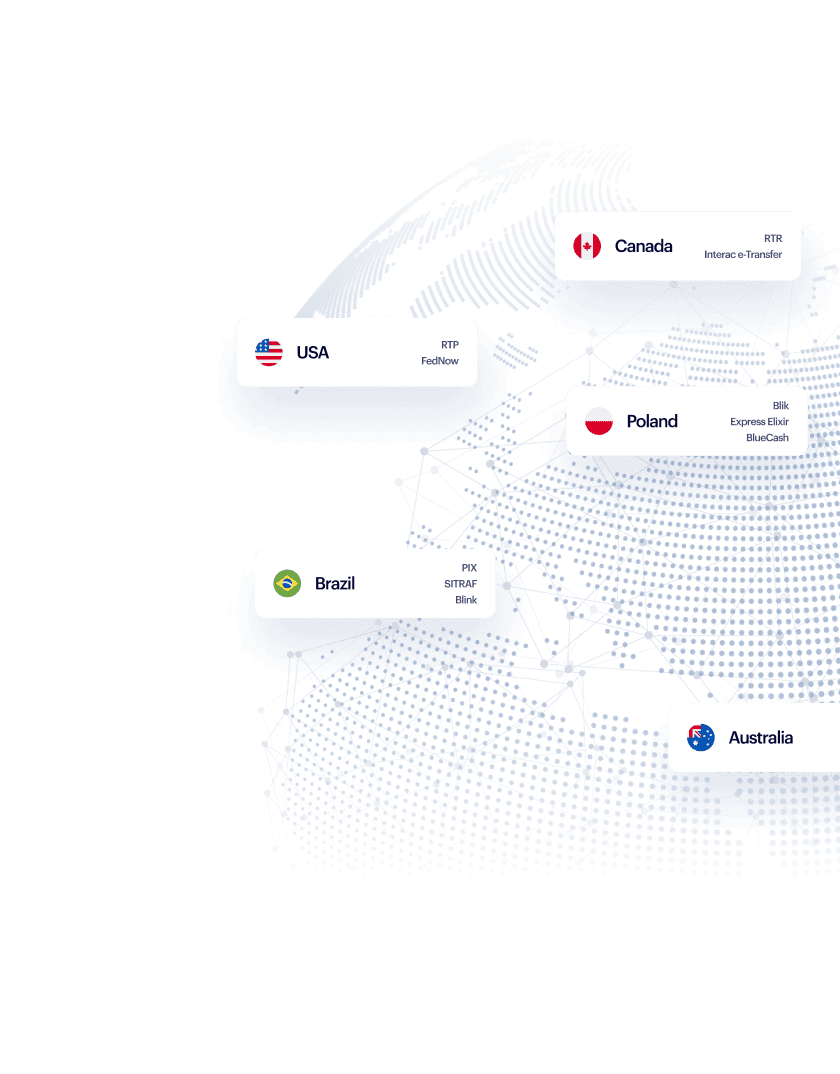

Real-time MAP

Real-time payments are going global

From the UK to Australia, the US to Brazil, 80+ countries around the world have rolled out their own real-time payment schemes. We’re on a mission to unite and harmonise them all.

Take a real-time payments world tour

Reach

Already live in three continents, and with plans to add more, we’re creating the world’s ‘network of networks’ for real-time open banking payments.

Scalability

Our vision is a one-stop solution to global connectivity. We’re equipped to integrate domestic networks into our own, as they launch.

Connectivity

We have multiple connections to the thousands of banks we process payments to and from, meaning we can boost resilience and reliability.

The future of payments is real time

Join the real-time revolution. Give your customers a faster, easier and safer way to pay.