Business

MoneyMatrix partners with Volt to power instant payments in the iGaming industry and beyond

London, UK, 5th August 2021 -- Volt, the London-based leading open payments gateway, today announces a new partnership with MoneyMatrix -- the Malta-founded iGaming-focused payments gateway -- to connect more merchants with Volt while helping MoneyMatrix expand its coverage on emerging markets beyond iGaming. The news comes just weeks after Volt announced the largest ever Series A funding round for the open banking industry, showing the company’s momentum.

MoneyMatrix is an EU licensed Financial Institution and PCI DSS Level 1 Certified payment service provider (PSP) and payment gateway for online real-money gaming and digital industries. Volt’s intelligent platform connects merchants and PSPs with open banking seamlessly, standardising and operationalising the PSD2 API interface to a single point of access. It offers multiple paths for each payment request, improving conversion rates and reliability by using machine-learning to optimise payment routing, delivering a unified experience for merchants and PSPs.

Adding Volt into the MoneyMatrix portfolio will be key to diversifying the instant banking solution with its connection to multiple banks, easy integration, and smart routing. Globally, merchants and PSPs are increasingly prioritising instant payments; through this new partnership, MoneyMatrix can be ahead of the curve in this space and Volt can help more merchants accelerate growth.

Commenting on this news, Alin Bidescu, COO of MoneyMatrix, said: “When it comes to payment solutions, MoneyMatrix is continuously searching for the best technology. Volt is an important player in the open banking and payments world, the customer appetite for which is undeniable. By working together, we can offer clients new payment initiation service (PIS) solutions through a fast and secure user journey. We can’t wait for what comes next.”

Jordan Lawrence, CCO at Volt, added: “We are delighted that MoneyMatrix has chosen Volt to power its instant payments offering. When using card payments, merchants incur high fees and have to wait days for settlement across multiple channels. Open banking is a much more cost-effective option that’s processed instantly; it’s also more secure than card transactions, as the threat of card fraud is eliminated. Speed and security are famously important in the online gaming industry -- but also for countless more markets, which is why we’re so excited about this partnership. Now, MoneyMatrix can bring the benefits of open banking to a wider range of customers.”

About MoneyMatrix

MoneyMatrix is the latest generation of processing platform that encompasses all of an operators’ payment processing and risk management needs. Utilising the best of breed technologies, MoneyMatrix can provide payment routing, risk management and KYC solutions globally through a single integration.

Based in St. Julians Malta, MoneyMatrix is licensed by the Malta Financial Services Authority and is PCI Level 1 Certified. MoneyMatrx is part of the EveryMatrix Group of companies.

Learn more at: www.moneymatrix.com.

About Volt

Founded in 2019, Volt is building the infrastructure for global instant payments. Today, its open payments gateway allows merchants and PSPs to process transactions securely between accounts held at more than 5,000 banks in the UK and EU. Volt’s unique aggregation model provides unrivalled open payments reach and maximises the speed, security and resilience of transactions.

For further information, please visit: https://volt.wp

When it comes to payment solutions, MoneyMatrix is continuously searching for the best technology. Volt is an important player in the open banking and payments world, the customer appetite for which is undeniable.

More like this

Business

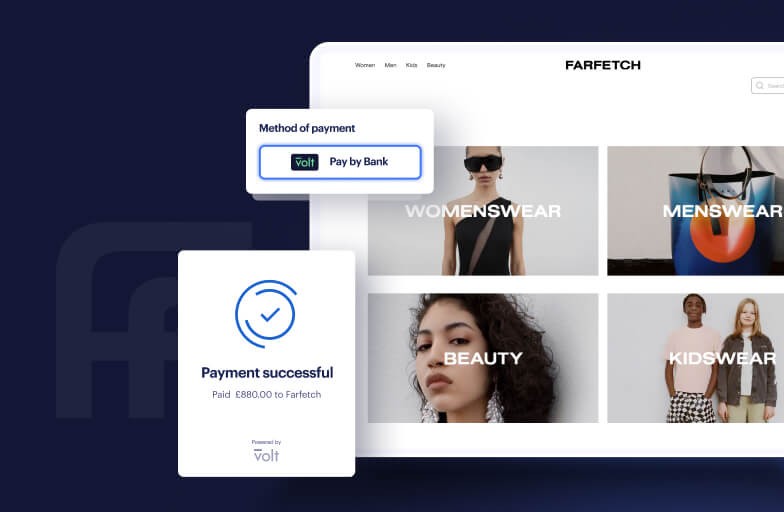

Farfetch partners with Volt to offer shoppers instant payments at checkout

The global luxury marketplace has switched on Pay by Bank for customers in the UK, Germany and the Netherlands.

Business

Volt launches VX2, a new stablecoin settlement solution, led by CEO Tom Greenwood

Tom will transition from his current role as Volt CEO to lead VX2, a groundbreaking new stablecoin settlement solution.

Business

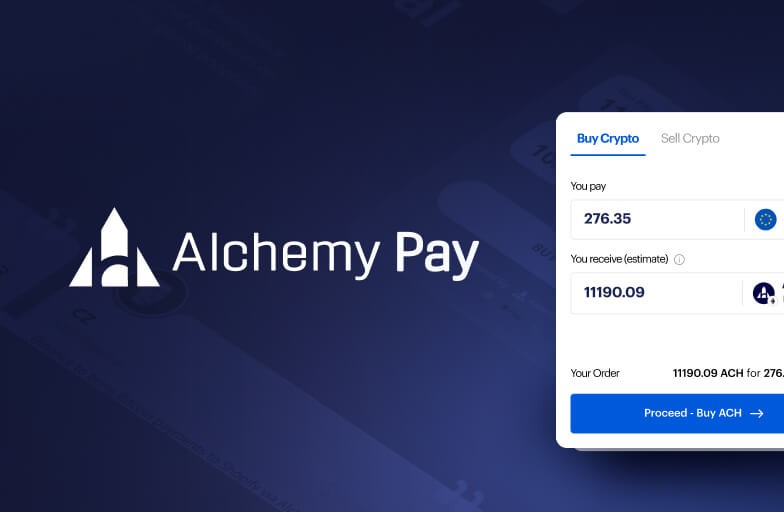

Volt’s real-time payment capabilities chosen by Alchemy Pay

Volt’s advanced open banking payment initiation capabilities will be integrated into Alchemy Pay’s on-ramp service.