Business

Shoplazza partners with Volt to enable cross-border open banking payments in Europe and Brazil

London, 25th April 2023: Award-winning e-commerce platform Shoplazza has partnered with Volt, the leading global real-time payments gateway, to enable its merchants to accept cross-border open banking payments in the European Union, the UK and Brazil.

Targeted at merchants in Hong Kong, Singapore and China, the integration marks an important milestone for Shoplazza in its mission to help more product-focused e-commerce businesses reach lucrative non-domestic markets – in as seamless a way as possible.

Volt’s open banking capabilities will enable Shoplazza’s merchants to receive real-time account-to-account payments from customers across Europe, the UK and Brazil via a virtual IBAN, with merchants able to sweep settled funds into their local account. This cross-border capability - available via a single API integration - is what Shoplazza needed from an open banking provider as part of its expansion plans.

Merchants will also have access to Connect, Volt’s cash management engine, which tracks payments from initiation to receipt and provides confirmation of funds - essential functionality that isn’t a given with all open banking payment providers.

Shoplazza hopes its integration of Volt will encourage more merchants to expand into Europe and beyond, with open banking technology – which Volt has effectively harmonised to a single standard – providing a faster, safer and more cost-effective means to reach new customers.

The partnership also reveals Volt’s potential as an e-commerce platform plug-in, with its market-leading checkout continuing to gain rapid traction among both online retailers and consumers. The former are taking advantage of everything from real-time settlements to open banking as a card payment recovery tool, while the latter are quickly becoming loyal to the lightning-fast ‘Pay by Bank’ experience.

Commenting on the partnership, Shoplazza’s Director of Financial Services Sharon Gao says: “Integrating Volt marks an exciting moment in Shoplazza’s evolution. Many of our merchants see the European and Brazilian markets as a huge untapped opportunity, but until now they’ve been put off by the cross-border complexities and high payment processing costs associated with cards. We have long seen the potential of open banking, but for us it was vital to partner with a provider that combined cross-continent coverage and simplified FX with a best-in-class payment experience. Volt delivers on both fronts, and we look forward to helping our merchants reach the markets that Volt provides easy access to.”

Matt Komorowski, Volt’s Chief Revenue Officer, says: “We’re really excited to be working with Shoplazza. As the leading e-commerce platform in APAC, it enjoys huge popularity domestically among a host of ambitious merchants with market-leading products. They deserve the opportunity to reach new customers in Europe and Brazil, who equally deserve the opportunity to be introduced to their products. Volt’s integration with Shoplazza makes this possible, while also revealing how suitable our technology is for e-commerce platforms. We’re really looking forward to seeing what this partnership achieves.”

More like this

Business

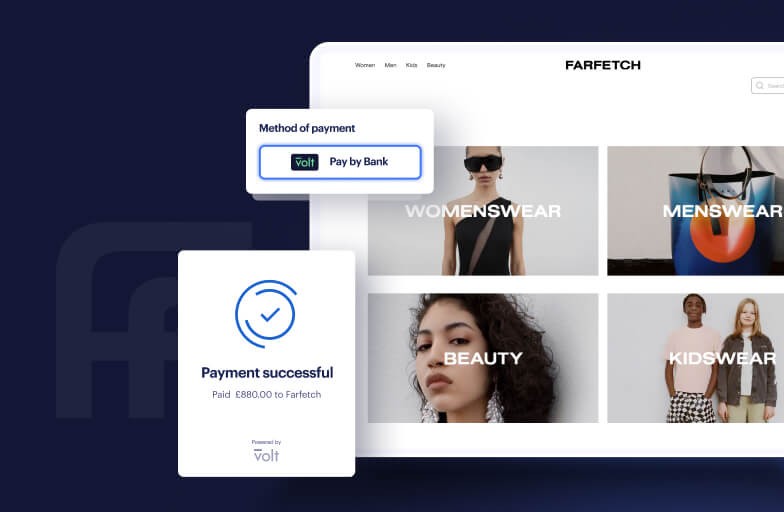

Farfetch partners with Volt to offer shoppers instant payments at checkout

The global luxury marketplace has switched on Pay by Bank for customers in the UK, Germany and the Netherlands.

Business

Volt launches VX2, a new stablecoin settlement solution, led by CEO Tom Greenwood

Tom will transition from his current role as Volt CEO to lead VX2, a groundbreaking new stablecoin settlement solution.

Business

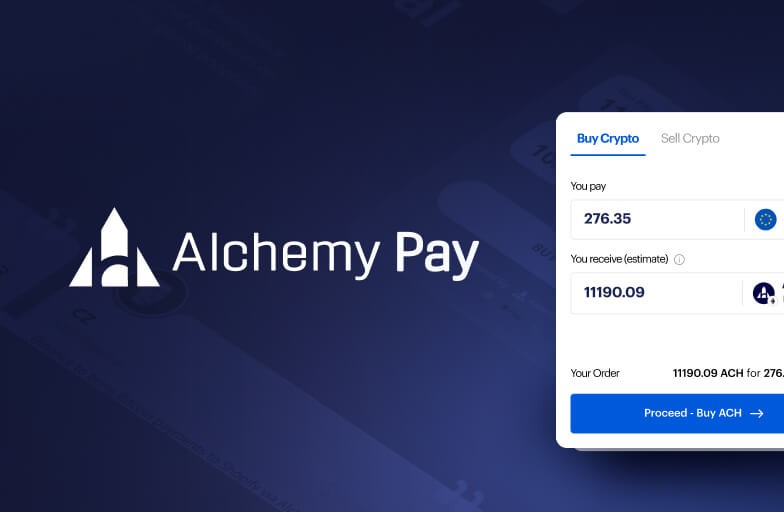

Volt’s real-time payment capabilities chosen by Alchemy Pay

Volt’s advanced open banking payment initiation capabilities will be integrated into Alchemy Pay’s on-ramp service.