Business

Singapore-based Tazapay partners with Volt to add open banking payments in UK and Europe

London, 28th February 2023: Tazapay, a Singapore-based cross-border payments provider, has partnered with leading global real-time payments gateway Volt to add open banking to its growing stack of payment offerings, as it accelerates its international growth plans across the UK and Europe.

The partnership will enable Tazapay’s customers to roll out and increase their cross-border sales, especially for APAC and MENA-based merchants looking to expand and increase sales in the UK and Europe.

Volt’s real-time reconciliation capabilities enable businesses to track payments from initiation to receipt, unlocking full visibility of the payment value chain via its data-driven insights and analytics. Over 70% of all payments processed via Volt’s gateway receive instant confirmation of settlement, a significant feature for cross-border merchants and businesses. Tazapay will also leverage Volt’s fraud prevention solution to identify and block any suspicious payments by monitoring transactions via a flexible scoring system.

Tazapay currently supports over 2,000 merchants across 30+ markets. It provides a full-stack payment solution that includes local payment methods as well as cards globally, with buyer and seller protection. The company has a global network of more than 170 markets for its card coverage, and 85 markets for its local payments collection coverage.

This strategic partnership with Volt, a leading player in open banking and real-time payments, unlocks growth for Tazapay in the UK and Europe and will be further continued by enabling open banking payments in Brazil later this year. Volt processes transactions securely between accounts held at over 5,000 banks in the UK, Europe and Brazil, covering over 680 million accounts.

The partnership marks another significant milestone for Tazapay, which has recently completed a $16.9m Series A fundraising round led by Sequoia Capital Southeast Asia, and has received in-principle approval for a major payment institution (MPI) licence from the Monetary Authority of Singapore (MAS).

Open banking continues to gain tremendous momentum in payments worldwide. The value of open banking-powered payments reached almost $4bn in 2021 and, by 2027, is expected to exceed $330bn. Over 60 countries currently have or are considering launching open banking frameworks, and Volt is building the global infrastructure to connect all the domestic systems worldwide via one single point of integration (API).

“With the advent of open banking and maturing of real-time payment networks like the PayNow service in Singapore and UPI in India, there is an increase in expectations from businesses and end consumers for payments to be done in real time. Tazapay is building the payments and compliance infrastructure for cross-border commerce and services, and we continue to focus our attention on growth plans. We are thrilled to be partnering with a like-minded company like Volt, who will support us in enabling seamless, real-time cross-border payments for our customers,” says Rahul Shinghal, CEO and Co-founder at Tazapay.

“This partnership demonstrates the global acceleration of real-time payments across many sectors – a complement to the acceleration of online business processes and an obvious fit for businesses now operating in a digital-first economy. We are excited to join forces with Tazapay and support them in their ambitions to offer cross-border instant payments, as well as data-driven analytics for better decision-making, supported by our proprietary solution Connect,” says Matt Komorowski, Chief Revenue Officer at Volt.

More like this

Business

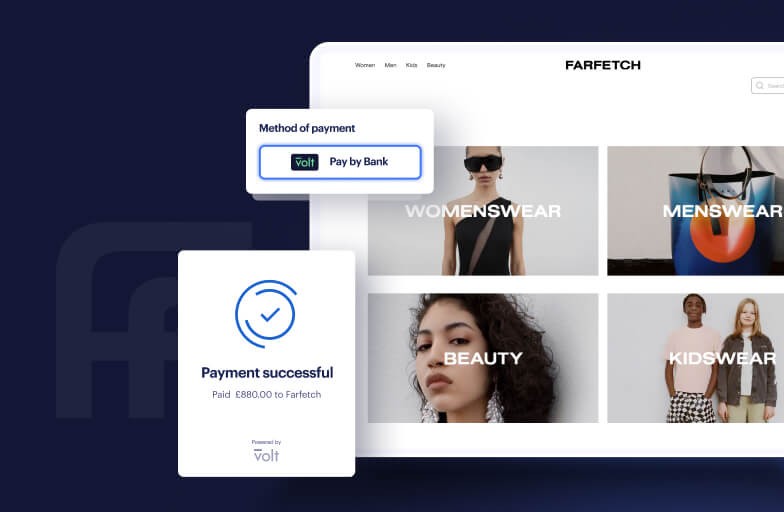

Farfetch partners with Volt to offer shoppers instant payments at checkout

The global luxury marketplace has switched on Pay by Bank for customers in the UK, Germany and the Netherlands.

Business

Volt launches VX2, a new stablecoin settlement solution, led by CEO Tom Greenwood

Tom will transition from his current role as Volt CEO to lead VX2, a groundbreaking new stablecoin settlement solution.

Business

Volt’s real-time payment capabilities chosen by Alchemy Pay

Volt’s advanced open banking payment initiation capabilities will be integrated into Alchemy Pay’s on-ramp service.