Business

Sumsub partners with Volt to enable open banking-powered user verification

London, 15th April 2025: Volt, the global real-time payments platform, today announces its new strategic open banking partnership with Sumsub, a global full-cycle verification platform. Volt will power Sumsub’s Penny Drop Verification flow, which involves an end user being directed to their banking app after scanning their identity document.

Once a user accesses their banking app, they will be asked to make a 1c payment – via Volt’s hosted checkout – which is later returned to the end user in real time. Matchmeter, one of Volt’s AIS solutions, will match the data in the payment flow – specifically the name of the account holder – to the name in the end user’s identity document.

Utilising Volt’s PIS (Payment Initiation Services) and AIS (Account Information Services) open banking capabilities across Europe, the partnership is enabling Sumsub to enhance its market-leading onboarding and identity verification products.

This additional layer is especially important in markets such as Germany, where the end user’s qualified electronic signature (QES) is often used to complete the verification process. Possessing the same legal power as a handwritten signature, a QES is recognised as a compliant identification method by European Union Anti-Money Laundering (AML) regulators. Ensuring the validity of a QES signatory’s information is therefore essential to businesses onboarding new users at scale.

Commenting on the partnership, Andrew Novoselsky, Chief Product Officer at Sumsub, said: “With regulatory landscapes becoming more complex and fraud evolving at an alarming pace, businesses need verification solutions that are both compliant and frictionless. Europe saw the second-highest increase in fraud globally, with cases surging 150% year-over-year – driven in part by increasingly sophisticated fraud tactics.

“AI-powered fraud is escalating rapidly, with deepfake-driven fraud alone increasing 4x worldwide from 2023 to 2024. These rising threats highlight the urgent need for secure, real-time verification. Our Penny Drop Verification solution ensures businesses can confidently stay ahead of increasingly advanced fraud attempts, safeguard their operations and protect users in an increasingly risky digital world.”

Matthew Rickard, Volt’s Senior Partnerships Manager, added: “Working with Sumsub exemplifies Volt’s commitment to partnering with innovative brands that recognise the value of real-time networks within their technical infrastructure. From day one, Sumsub has had a clear vision of unifying the consumer verification experience across multiple markets. Volt’s global orchestration of account-to-account networks aligns closely with this vision, and I’m excited to continue driving this innovation forward.”

About Volt

Volt is building the global infrastructure for real-time payments. Our payment network is the first to unite domestic account-to-account schemes to a single interoperable standard. Scaling and enterprise businesses use it to accept real-time payments, initiate payouts and manage funds. Volt is headquartered in London, has offices in Berlin, Warsaw, Kraków, Sydney and São Paulo, and enables payments in 31 markets across the UK, the EU, Brazil and Australia.

About Sumsub

Sumsub is a full-cycle verification platform that secures the whole user journey. With Sumsub’s customisable KYC, KYB, transaction monitoring, and fraud prevention solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements, reduce costs, and protect your business.

Sumsub has over 4,000 clients across the fintech, crypto, transportation, trading, e-commerce, education, and gaming industries, including Bitpanda, Wirex, Avis, Bybit, Vodafone, Duolingo, Kaizen Gaming, and TransferGo.

Sumsub has citations in research published by global institutions such as the United Nations and Statista, as well as ongoing consultancy and engagements with INTERPOL.

More like this

Business

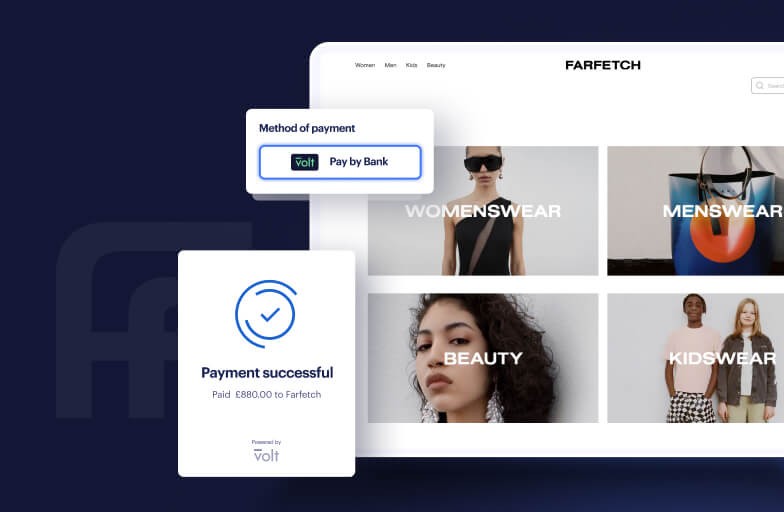

Farfetch partners with Volt to offer shoppers instant payments at checkout

The global luxury marketplace has switched on Pay by Bank for customers in the UK, Germany and the Netherlands.

Business

Volt launches VX2, a new stablecoin settlement solution, led by CEO Tom Greenwood

Tom will transition from his current role as Volt CEO to lead VX2, a groundbreaking new stablecoin settlement solution.

Business

Volt’s real-time payment capabilities chosen by Alchemy Pay

Volt’s advanced open banking payment initiation capabilities will be integrated into Alchemy Pay’s on-ramp service.