Market insights

What is open banking, and how is it being rolled out around the world?

Your complete guide to global open banking, from the domestic schemes to key use cases and adoption figures.

Market insights

Real-time payments are coming in for landing in Australia

Kris Rogers explains how PayTo is plugging the gap left by POLi’s disappearance, and why this is good news for airlines.

Market insights

How PayTo compares to other payment methods in Australia

Explore the advantages of PayTo over other payment methods in Australia when it comes to fees, transaction speed, security, and user experience.

Market insights

From screen scraping to PSD3: The growth of open banking in DACH

We look at open banking in DACH, starting with the German Federal Post Office’s experience to the upcoming PSD3 and Payment Services Regulation.

Market insights

Real-time payments in the US: 10 key use cases

We explore how real-time payments can benefit everyday use cases in the US, from online winning payouts to ensuring utility bills are settled instantly.

Market insights

Understanding the Australian payments landscape

We explore the Australian payments landscape, including the rise of wallets and the impact of open banking.

Market insights

Surcharging and PayTo: How to cut costs for your business

Surcharges are inevitable with card payments in Australia, but with PayTo merchants can bypass fees and save their customers money by enabling account-to-account payments.

Market insights

How to prevent card-not-present fraud in Australia with PayTo

Australia's PayTo is actively lowering the risk of card-not-present fraud by facilitating real-time account-to-account payments.

Market insights

ACH vs RTP vs FedNow: All you need to know about US payment rails

We look at the evolution of real-time payments in the US, and how the latest arrival - FedNow - is making an impact.

Market insights

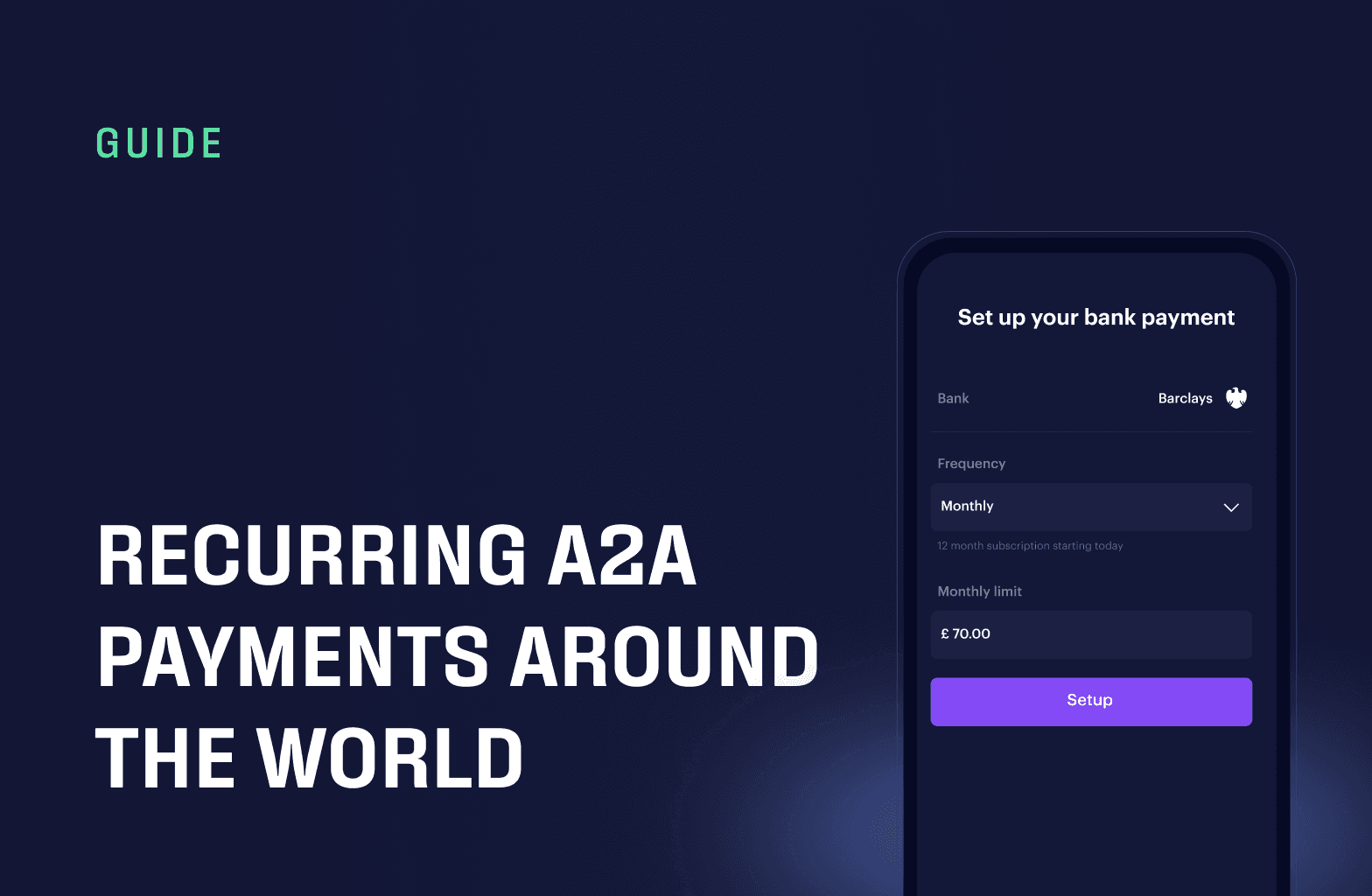

A guide to recurring account-to-account payment schemes

How do recurring A2A payments models look worldwide, from Variable Recurring Payments (VRPs) in the UK to Pix Automático in Brazil?

Market insights

Why include Brazil in your global e-commerce strategy?

Cross-border commerce and accelerated Pix adoption create huge opportunities for global companies.

Market insights

What is Pix and how is it driving Brazilian e-commerce?

The real-time payment scheme is unprecedented in its acceptance. What’s the impact of its success?