Market insights

Understanding the Australian payments landscape

In 2024, Australia's payments market size is estimated to be worth USD 0.92 trillion, and by 2029 it is expected to increase to USD 1.97 trillion, with a compound annual growth rate (CAGR) of 16.44%.

This growth is driven by high internet penetration, increasing adoption of digital wallets, the rise of e-commerce, government initiatives promoting digital payments, and the expansion of real-time payments infrastructure.

High internet penetration (96%, making Australia the 18th most connected country in the world), widespread smartphone usage, and a tech-savvy population are also driving the e-commerce boom in the country.

Australia is the 12th largest e-commerce market in the world. It’s ahead of countries such as Brazil, which has a population seven times bigger, and Italy, whose population is three times bigger. And the market revenue is forecast to grow by 9.1% CAGR, reaching USD 75,184 million by 2028.

As Australians' purchasing behaviours evolve, so do their preferences for payment methods that best meet their needs for ease of use, speed, security, and reduced costs.

Main payment methods in Australia

According to Worldpay's Global Payments Report 2024, digital wallets account for 31% of e-commerce payments in the country. Australians seeking a fast and secure checkout process without having to manually enter card details have embraced Apple Pay, Google Pay, and Samsung Pay with open arms.

Over a quarter (27%) of online purchases are made through credit cards, due to their widespread acceptance, familiarity, and benefits like rewards programmes. Debit cards account for 22% of e-commerce payments in Australia, followed by Buy Now, Pay Later (BNPL) at 15%, account-to-account (A2A) at 4%, and cash on delivery and other methods making up the remaining 1%.

At Point of Sale (POS), debit cards take the lead with 39% of the market share. Australians, especially the younger generation, prefer debit cards because they are easy to use and allow them to pay securely without the risk of accruing debt.

Credit cards capture 34% of the in-store market, while digital wallets are gaining traction as well. Fuelled by the pandemic's accelerated growth, payments by contactless are now 15% of POS transactions.

Despite the rise of digital payments, cash still holds a presence at point of sale, with 7% of transactions. It remains popular for small purchases and for its simplicity.

These numbers clearly show that Australians are looking for secure and easy ways to pay and control their money without the risk of debt. This demand is driving the rise of A2A payments, which include options like manual bank transfers, PayID, and PayTo. Currently, A2A payments make up 4% of online transactions, but this figure is expected to grow as PayTo, the government-mandated payment system built on the principles of open banking, gains traction.

From POLi to PayTo

POLi was introduced in 2006 as an online payment method that allowed users to make payments directly from their bank accounts without using a credit card. It quickly gained popularity for its lower transaction fees, especially among consumers who preferred to avoid using credit cards online, and near instant settlements.

For over a decade, POLi was widely used - particularly by businesses in the travel industry - across Australia and New Zealand, despite its limitations. This service raised security concerns among some users because they had to access their online banking through the POLi platform.

It also had limited compatibility with banks and a subpar user experience compared to emerging payment technologies. As new technologies emerged, the need for a more secure, efficient, and widely accepted payment method became apparent.

In 2021, POLi was gradually phased out, and its services discontinued. Consumers can now embrace the benefits of open banking offered by the New Payments Platform (NPP) and PayTo.

How PayTo addresses POLi’s limitations

PayTo addresses several fundamental limitations of its predecessor, offering a more secure, efficient, and user-friendly payment solution:

- Improved security. With PayTo, users authorise payments directly through their banking apps, without having to share banking credentials with third parties, which reduces the risk of fraud.

- Real-time payments. PayTo was built on the NPP infrastructure to provide real-time payment confirmations, ensuring swift and secure transactions for both consumers and merchants.

- Consistent user experience. POLi’s experience could vary, depending on the bank and the specific integration used. With PayTo, users approve payments within their bank app after checkout, for a uniform and more streamlined process.

- Centralised architecture. PayTo integrates all banks into a single platform, while POLi involved direct integrations with individual banks.

- Recurring and mandate-based payments. PayTo supports these types of payments, allowing users to authorise recurring and variable payments directly within their bank apps. This functionality is built-in and more advanced compared to POLi, which relied on banks improving their APIs to offer similar capabilities.

- Wider bank support. A step-change from POLi’s limited acceptance, PayTo is supported by all major Australian banks as part of the NPP, which ensures broad compatibility and accessibility.

- Regulatory backing. PayTo is backed by the Australian government, which aims to replace the current infrastructure, Bulk Electronic Clearing System (BECS), with PayTo by 2030. POLi lacked similar governmental backing.

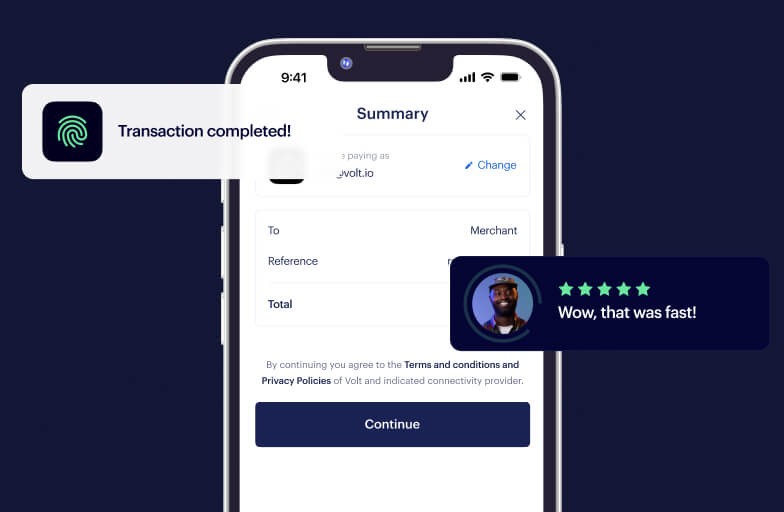

Unlock new capabilities with real-time payments

Jordan Lawrence, our Co-founder and Chief Growth Officer, says: "PayTo is very advanced with features like recurring payments to replace direct debits and one-click payments. It's a more mature product that will soon become the preferred choice over traditional methods."

With issues like fraud, chargebacks and slow settlements ever present with card payments, and the younger generation more conscious of their spending habits than ever before, both merchants and consumers will only benefit from the unrivalled capabilities that come with PayTo’s real-time payments.

Learn more about our PayTo integration here.

More like this

Market insights

How PayTo compares to other payment methods in Australia

Explore the advantages of PayTo over other payment methods in Australia when it comes to fees, transaction speed, security, and user experience.

Market insights

From screen scraping to PSD3: The growth of open banking in DACH

We look at open banking in DACH, starting with the German Federal Post Office’s experience to the upcoming PSD3 and Payment Services Regulation.

Market insights

Real-time payments in the US: 10 key use cases

We explore how real-time payments can benefit everyday use cases in the US, from online winning payouts to ensuring utility bills are settled instantly.