Open banking

Open banking APIs: What are they, and how do they work?

Open banking APIs are rapidly evolving. This technology is transforming digital payments by bypassing card infrastructure and enabling funds to flow from account to account – with instant settlement, and at a fraction of the cost of cards.

Thanks to their magic, regulated third parties like Volt can initiate payments or retrieve information directly from a shopper’s bank account.

But what exactly are open banking APIs: how do they work, and what does the future hold for this technology?

What are open banking APIs?

API stands for 'application programming interface'. An open banking API connects databases and third-party applications, enabling financial institutions and merchants to access customer data. These interfaces, made up of codes and protocols, allow one software type to connect and share information with another.

For example, when you log in to Airbnb via Facebook, Facebook's API tells Airbnb which user is signing in.

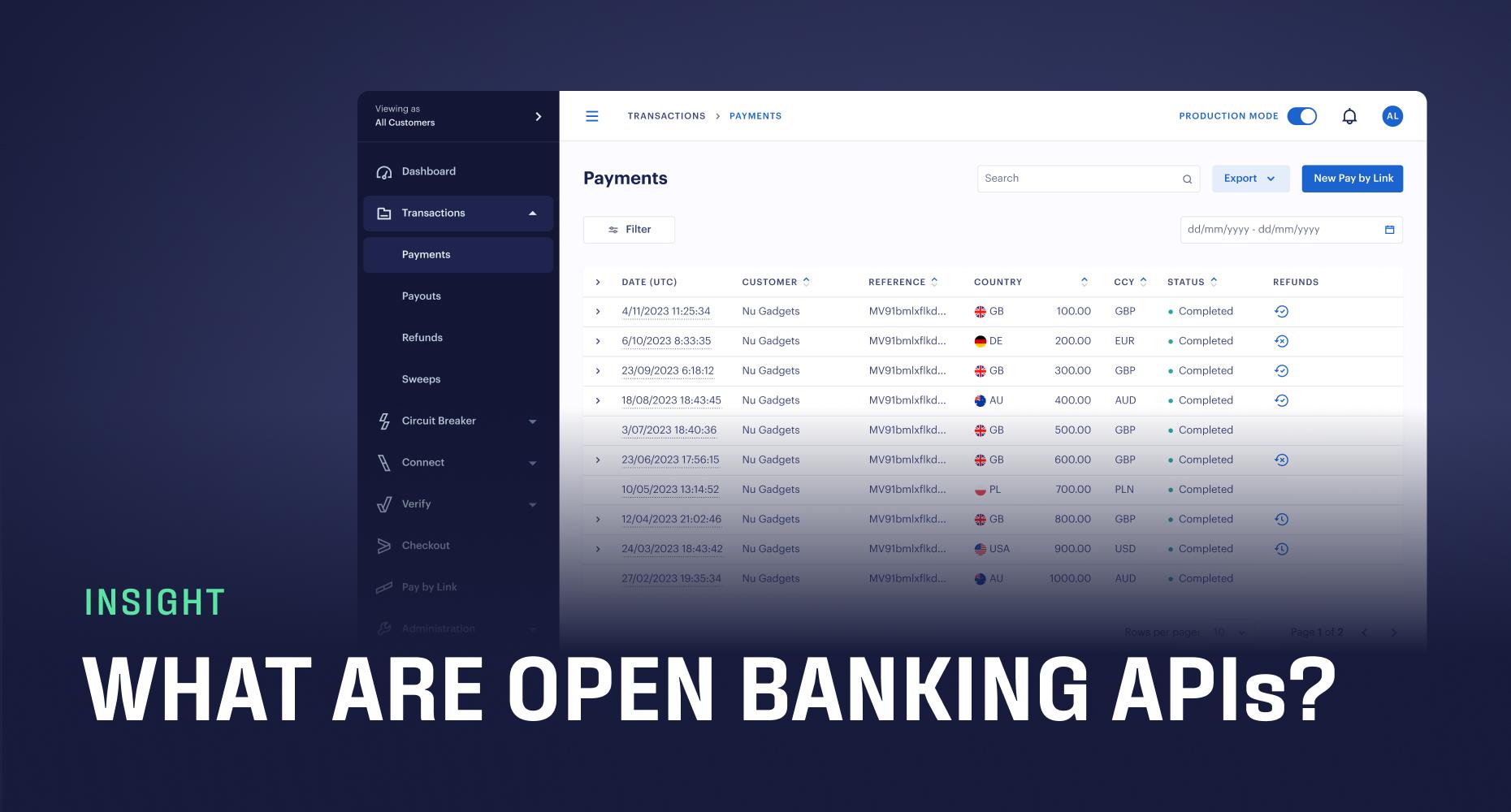

In open banking payment terms, Volt aggregates multiple bank APIs to provide a single reliable API connection for merchants and payment providers, addressing open banking adoption challenges. It means with a single API, businesses can plug into Volt and offer customers real-time payments at checkout.

Understanding open banking APIs

When PSD2 took effect in 2018, banks in the European Economic Area and the UK had to create APIs that securely open their customers' data to third parties – hence 'open' banking.

This enabled these third parties to provide payment initiation or account information services (PIS and AIS).

PIS: Granting permission to a regulated third party to initiate a payment to a merchant directly from the customer’s bank account.

AIS: Granting permission to a regulated third party to retrieve information from the customer’s bank account. So a merchant can assess affordability.

Open banking is good news for everyone.

For end users, this means they can use services or apps that make their financial lives more manageable. For third-party providers (fintech companies), this means creating and monetising these services. For banks, it means staying ahead of the curve because they're partnering, not competing, with fintechs.

What open banking APIs enable merchants to do

Open banking APIs present multiple benefits for merchants, which include:

Initiating payments

As we covered above, with PIS APIs payments can be initiated directly from bank accounts, bypassing the need for the longer, arduous card payment process. These account-to-account payments settle instantly, in real time, providing a seamless and secure experience for customers and predictable revenue for merchants.

Seamless verification

While Strong Customer Authentication (SCA) is an effective method of verification, it creates another layer of friction for customers. Open banking APIs enable quick and easy identity verification – customers are redirected to their banking app, where they use biometrics to complete the verification process in seconds.

Volt’s Verify tool allows organisations to authenticate customers seamlessly without manual intervention.

Fraud prevention

Not only does the verification process keep fraudsters at bay, but the overall payment taking place within the customer’s online banking environment, it instinctively benefits from bank-grade security.

As the customer simply selects their bank and completes the payment, they don’t share any sensitive data at all – everything is encrypted and tokenised. It means hackers have very little data to target, reducing the risk of fraud.

Data-driven customer experiences

With AIS APIs, businesses can - with the customer’s permission - access detailed financial and banking data from within the customer’s bank account, such as spending habits and statements. This information can inform strategic decision-making, risk assessment and investment planning. As a result, businesses can offer tailored, individualised services, enhancing the overall customer experience while increasing collaboration between legacy banks and newer technologies.

The growth of open banking APIs

Data shows that these benefits are being realised at impressive speed. In the UK, there were almost 1.5 billion successful API calls (in other words, when a third-party provider requests data from a bank) in June 2024 alone, compared to just over 1.1 billion a year earlier. And according to Juniper Research, the number of open banking API calls is forecasted to grow to 580 billion by 2027 - that’s more than five times the amount in 2023 (102 billion).

While APIs are sparking a sea change in how we move and manage money, they don't drive adoption. They're simply how a third-party provider can access banks' customer data to provide a service. Adoption itself is dependent on:

- The reliability of bank APIs, which isn't a given considering there's no single global standard

- Third-party providers create reliable services that people want to use

Across Europe, industry bodies like the OBIE are few and far between. As a result, the quality of bank APIs varies across countries. The noticeable knock-on effect is that third-party providers need help to provide reliable, scalable services that offer end users a consistent experience.

Volt's open banking API

At Volt, we provide merchants and payment service providers with a single API connection. It's unique because it offers multiple connections to bank APIs in various territories.

What does this mean? First, the payments we initiate are more likely to convert. Multiple bank connections mean no single point of failure (we actually' smart route' payments not just for resilience but for speed). Second, we can go some way to standardising the open banking payments experience - such is the reach and consistency of our network.

However, it's not just a case of providing a single API. A 'successful' API call can fail in practice, so for us, it's about how merchants use it. We 'productise' our API to create seamless payment processes that use all relevant features of a given bank API to deliver maximum benefit for merchants.

It all boils down to our core mission: creating the world's first real-time payment network. We can only do this by operationalising open banking payments to their full potential. And, while we've come a long way already, we're only just getting started. Experience Volt’s open banking API for your business by requesting a demo today.

More like this

Open banking

Industry deep dive: Exploring player behaviour trends in eGaming

We uncover the latest player habits shaping the eGaming landscape, and how open banking delivers on the demand for superior in-game payment processes.

Open banking

How much are card fees: A complete guide to processing costs

From interchange fees to scheme costs, we explore the full set of expenses that come with accepting card payments - and how they can be avoided through open banking.

Market insights

From screen scraping to PSD3: The growth of open banking in DACH

We look at open banking in DACH, starting with the German Federal Post Office’s experience to the upcoming PSD3 and Payment Services Regulation.