Take charge of your chargebacks: Five tips to protect your revenue

No one wants to see all their hard work go to waste. As a retail business with regular sales cycles, you’ll know how much time and effort is put into preparing and maintaining everything from your product pages to your online checkout to ensure smooth sailing for your customers.

But the spirit of success is dampened after the excitement of seeing your website traffic and transactions increase when you’re hit with chargebacks. In fact, it was predicted merchants will have paid more than $100 billion in chargebacks alone in 2023. That’s not exactly a reason for celebration.

It doesn’t have to be this way though. We’re here to share our top advice on how you can steer clear of chargebacks.

Chargebacks unpacked

A chargeback is, in most cases, a last resort. Unlike a refund, in which you as the merchant repay the amount, a chargeback is triggered by a customer contacting their bank to dispute a charge to their debit or credit card. Upon approval, the bank returns the funds to the customer’s account.

As a business you can challenge the chargeback with a sufficient defence document, but this complicates the process further. And when you add the chargeback fee to all the other costs that come with a transaction, the overall price only gets higher.

What causes chargebacks?

There are different scenarios in which a chargeback can occur, below are just a few:

- The item/product ordered never arrived

- A service was not carried out

- The order arrived damaged or incomplete

- The customer was charged the wrong amount

- The customer suspects a payment from their account is fraudulent

- The customer fraudulently claims the item never arrived

Five ways to reduce chargebacks

Unfortunately, it’s impossible to banish chargebacks into the abyss and go about your day when it comes to card payments. But there are ways you can bring the number down and keep customers happy so they won’t dispute.

Utilise strong customer authentication

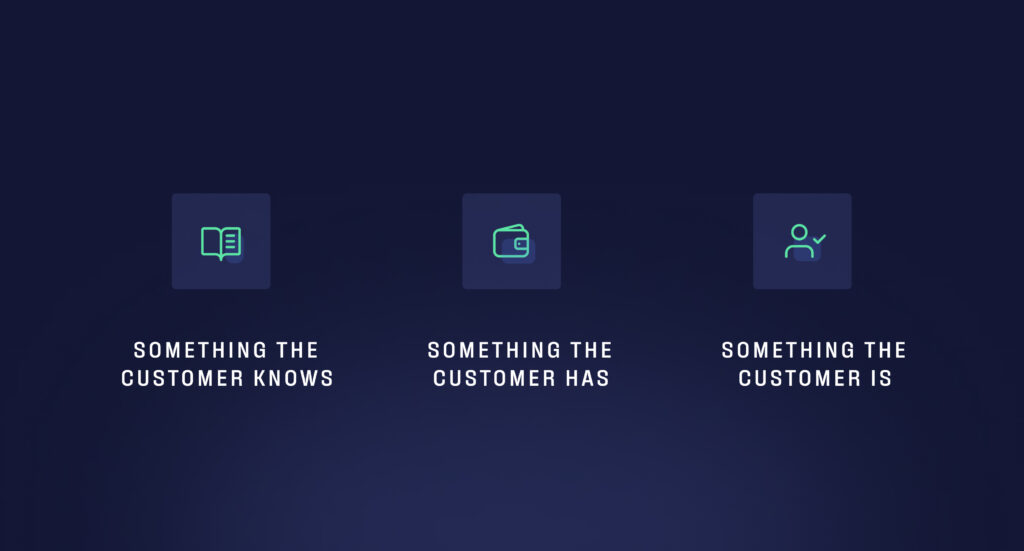

When it comes to fraudulent transactions, stopping the payment before it happens is the most effective way to prevent a chargeback. By implementing strong customer authentication (SCA) via 3D Secure v2 (3DS2), under the revised Payments Service Directive (PSD2), buyers must provide two of three criteria:

- Something they know (a passcode, for example)

- Something they are (facial recognition, fingerprint)

- Something they have (a registered device)

This will prevent payments being initiated by anyone who isn’t the cardholder if card details are stolen, as they won’t match the criteria.

Make refund, cancellation and return policies crystal clear

Rather than hiding key details on how customers can return items, make the step-by-step process prominent from the get-go. Display it both in the cart and on the checkout, and give customers the opportunity to ‘Cancel’ straight after ordering if they’ve changed their mind.

Clear timelines will manage expectations too, such as giving customers a timeframe on when to expect the amount to be refunded into their account. The more clarity you provide, the better protected you are from people feeling misled and frustrated enough to prompt a chargeback.

Use a name customers will recognise on their statement

Going back to the case of a customer suspecting a payment may be fraudulent, it may be the case that the reference they see on their bank statement isn’t your business’ name. It may be an internal name, or that of your PSP. If you haven’t given a disclaimer beforehand, this ‘unexpected’ payment will unsurprisingly cause suspicions and, most likely, a chargeback.

Using your brand name for billing will save confusion, as will using clear descriptors, such as address or a short description of your business.

Support your customer service team

Delivering excellent customer support is only possible if your agents feel comfortable and supported. Being on the frontline of disappointed, frustrated and sometimes angry customer complaints and demands isn’t an easy job. But when handled professionally, calmly and with empathy, dramatic actions – such as chargebacks – can be prevented.

Having multiple channels of communication, such as WhatsApp, email, phone call and instant messaging, lets people get in touch in the way they prefer, and always offer a transcript where messages cannot be saved. Provide contact details on all confirmations of order, including the email receipt, so they are easy to locate.

Swap card payments for open banking

While chargebacks can’t be eliminated entirely with card payments, there is a way your customers can pay easily without putting your revenue at risk.

With open banking, the customer is in the driving seat of their finances. Take Volt; instead of going through the manual data entry that comes with making card payments, customers give us, a licensed third-party, permission to access their bank data via APIs and facilitate the payment.

The customer simply logs into their banking app, usually via biometrics, where their payment is pre-populated and awaiting their approval. Once initiated, it arrives in your business’ account near instantly. Since the payment is made from within the customer’s online banking environment, it comes with robust security, plus no data are shared throughout the entire process – unless they wants us to remember who they bank with for next time.

Not only is this practice built to prevent chargebacks, but it also saves you fees that come with credit and debit cards while providing customers with the best possible payment experience.

Are you ready to take on future sales seasons without sleepless nights worrying about chargebacks? Let’s talk about how Volt can help you.