Open banking

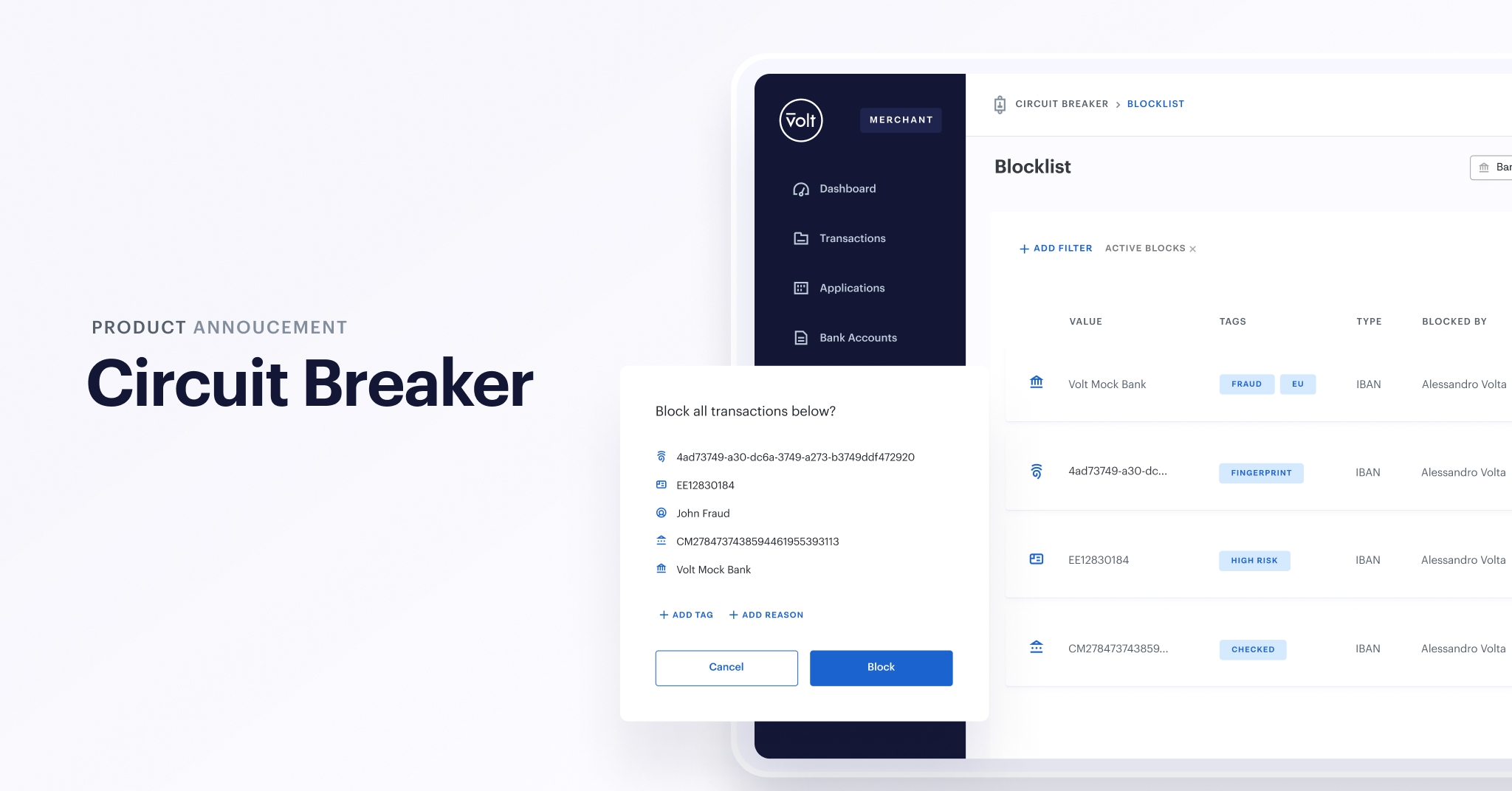

Introducing Circuit Breaker: Open banking’s first fraud prevention solution

Thursday 4th November 2021: Today, we’re excited to launch Circuit Breaker – the first fraud prevention solution developed exclusively for the open banking space.

It’s been clear for a while that such a solution is needed. While open banking doesn’t create new fraud risks per se, it does create opportunities for fraudsters: account takeovers, for example, or targeting banks’ own PSD2 implementations for PIS.

This was illustrated in no uncertain terms in October, when millions of pounds were stolen from Barclays accounts – by a fraudster using a Monzo account and a PISP.

Circuit Breaker prevents such high-velocity attacks in two ways. First, its flexible rule system – which applies a score to each payment received. This score is based on rules like volume of transactions, number of initiated transactions, and transaction amount.

If the additive score triggered by these rules equals 100 or higher, the transaction is blocked and the fraud attack prevented. These rules can be amended by merchants according to their changing needs – for example, during a period of growth.

Second, Circuit Breaker enables merchants to create blocklists of confirmed fraudsters based on set criteria such as the bank they’re paying from, their device fingerprint, and their email address. To build them, merchants simply choose their preferred criteria, set a value against them, and select ‘block’.

Steffen Vollert, Volt’s Chief Technology Officer, said: “Circuit Breaker is designed like a surgical tool – to specifically address issues with specific banks or clearing mechanisms, and to overcome the operational inhomogeneity of the European banking landscape.

“One big problem is that banks apply their fraud prevention systems – designed for a cards world – to open banking. This can result in merchants being blocked, often without explanation, in the event of a fraud attack. Circuit Breaker overcomes this by ‘filtering at the gate’ before sending transactions to the bank.

“Circuit Breaker is especially effective when used in combination with Volt Connect because, together, they offer merchants full-payment-cycle insight. This is a first for open banking.”

Circuit Breaker is designed like a surgical tool – to specifically address issues with specific banks or clearing mechanisms, and to overcome the operational inhomogeneity of the European banking landscape.

More like this

Open banking

Industry deep dive: Exploring player behaviour trends in eGaming

We uncover the latest player habits shaping the eGaming landscape, and how open banking delivers on the demand for superior in-game payment processes.

Open banking

How much are card fees: A complete guide to processing costs

From interchange fees to scheme costs, we explore the full set of expenses that come with accepting card payments - and how they can be avoided through open banking.

Market insights

From screen scraping to PSD3: The growth of open banking in DACH

We look at open banking in DACH, starting with the German Federal Post Office’s experience to the upcoming PSD3 and Payment Services Regulation.