Payment innovation

Pay by Link: Never miss a chance to convert

Our new Pay by Link open banking solution allows you to connect with purchase-ready customers on whatever channel they happen to be using.

It’s built on the premise of never missing an opportunity to convert. If a shopper sees a product they like, or a service they need, they can make their purchase then and there – without any additional steps.

What exactly is Pay by Link?

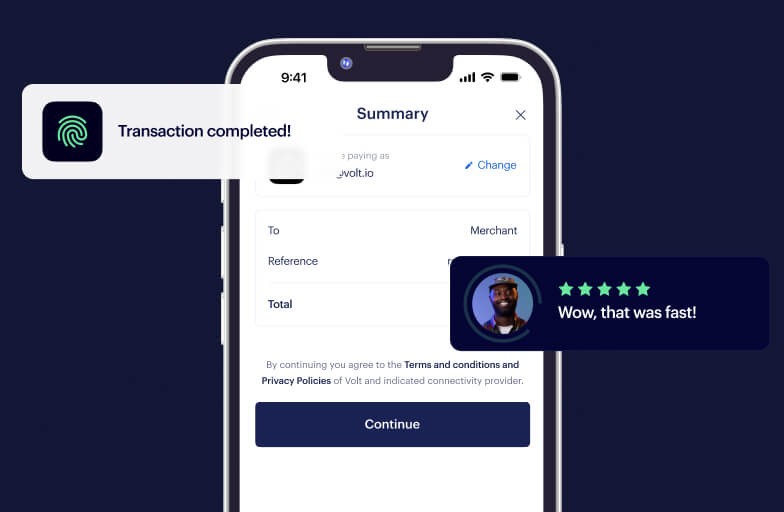

The clue really is in the name. Pay by Link is a solution that allows customers to pay via a simple, secure link. This link takes the shopper to their banking app or online banking via Volt’s checkout – where their transaction is ready to be approved and initiated.

Hasn’t it been around for a while?

Pay by Link, also known as ‘request to pay’, has been a mainstay of the hospitality industry for a while. Hotels, for example, often send customers payment links as part of the booking process.

Now, though, it’s finding popularity in other sectors – from e-commerce to local government. And while Pay by Link has historically been tied to card payments, we believe it’s a perfect facilitator of real-time, bank-direct payments – which are inherently faster, safer and more cost effective.

Pay by Link use cases

The beauty of Pay by Link is its versatility. Because it spans industries and channels, it essentially defines contextual commerce – in other words, enabling customers to buy where and when they want, with the least possible friction.

Here are three strong potential use cases…

1. Chatbots

Say you’re using an online travel agent’s chatbot or live chat. It shares a bespoke itinerary for next summer’s holiday, and you like what you see. A payment link can then be sent, allowing you to seamlessly make a deposit and secure your trip.

2. B2B platforms

Payment links can also come in the form of QR codes. These are ideally suited to B2B invoices because they eliminate the labour and risk associated with manually retyping data. Simply scan and go.

They help with chasing unpaid invoices, too. Payment links can be easily added to email or SMS reminders.

3. E-commerce

The average cart abandonment rate is around 70%. And according to BridgerPay, 62% of customers who experience payment failure during the course of a transaction won’t return to the merchant. Fortunately, Pay by Link helps alleviate both problems.

How? Well, by giving shoppers a faster, easier way to pay. “Still want to purchase this item? Do so in seconds using this link.” “Your card payment failed, but don’t worry – you can securely check out from your bank account instead.”

How does Pay by Link work?

Because our Pay by Link solution is API driven, it can be easily integrated into any external system you have – allowing you to scale and automate your operations.

The payment links you generate will include the currency, the amount and a unique identifier. They’re then shared with your customer, either via a link or a QR code. That’s all there is to it.

The shopper, for their part, needs only to open the link or scan the QR code to complete their payment – direct from their banking app or online banking – in seconds.

Interested in learning more? Book a demo to see Pay by Link in action.

More like this

Open banking

Industry deep dive: Exploring player behaviour trends in eGaming

We uncover the latest player habits shaping the eGaming landscape, and how open banking delivers on the demand for superior in-game payment processes.

Open banking

How much are card fees: A complete guide to processing costs

From interchange fees to scheme costs, we explore the full set of expenses that come with accepting card payments - and how they can be avoided through open banking.

Market insights

How PayTo compares to other payment methods in Australia

Explore the advantages of PayTo over other payment methods in Australia when it comes to fees, transaction speed, security, and user experience.