Payment innovation

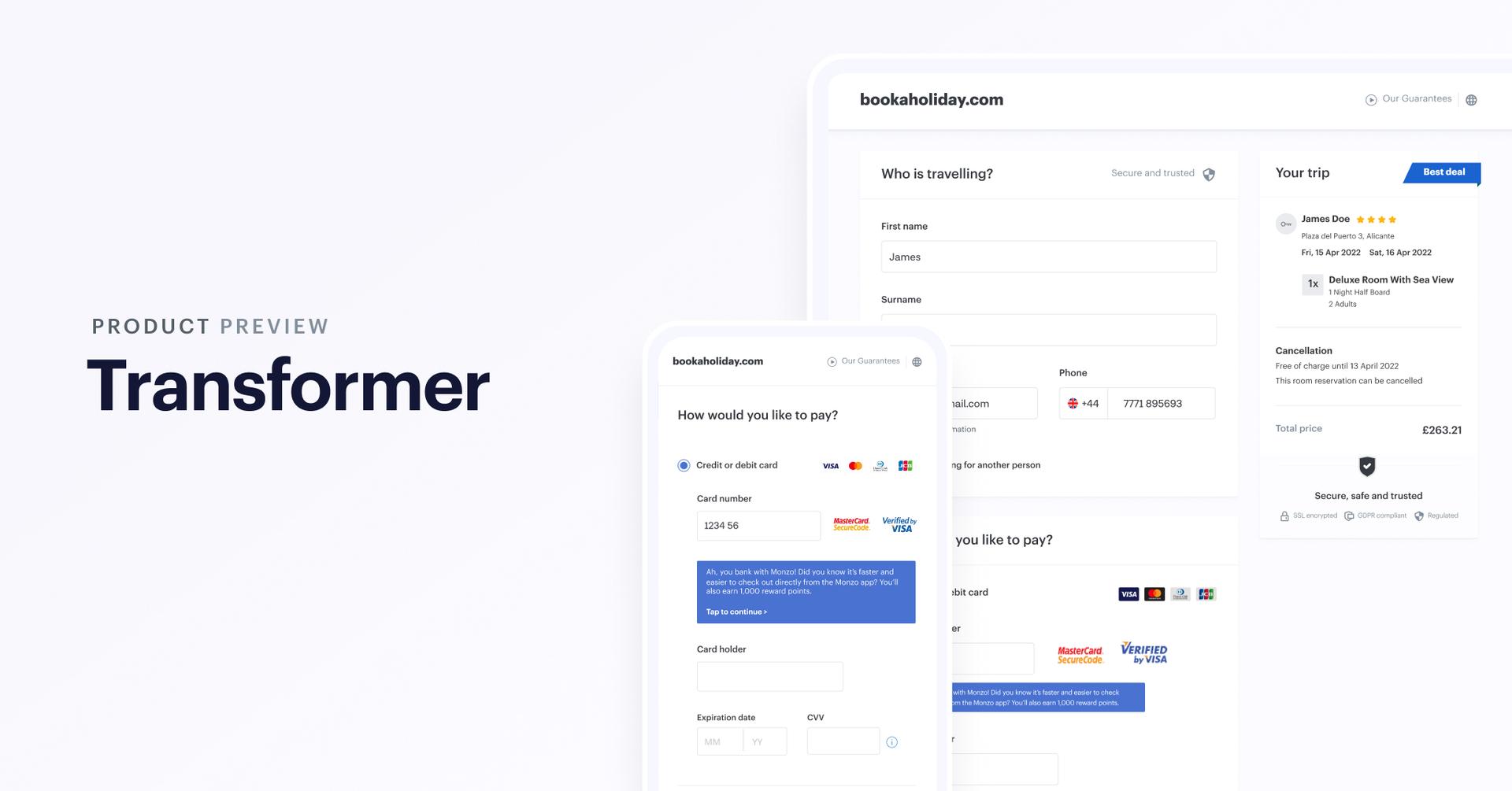

Transformer: Bypass high interchange fees by converting debit card payments

Our latest product helps merchants save on excessive debit card interchange fees by encouraging shoppers to switch to open banking payments at the checkout.

After intelligently recognising who a shopper banks with, Transformer helps merchants prompt them to instead pay direct from their bank account.

Here’s how it works…

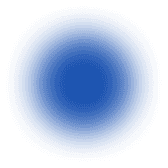

A shopper chooses to pay by card on the merchant’s checkout, reaches for their debit card, and starts entering their card number.

The first six to eight digits are the bank identification number (BIN). Once these are inputted, Transformer provides an API endpoint that tells the merchant: “BIN 123456 belongs to bank X”. The merchant then decides how to incentivise the shopper to instead make an open banking payment.

Consider how well this would work for online travel agents (OTAs), which are lumbered with not only high interchange fees, but slow settlement times and the operational headache of customer cancellations and refunds.

Transformer not only gives them a superior alternative to cards in the form of open banking payments, but actually helps them to persuade their customers – via an incentive of their choosing – to use it.

The benefits are obvious: real-time settlements, smaller transaction fees and improved customer loyalty. If a shopper starts earning reward points at the point of sale, via a payment method that’s easy compared to cards, you can be sure of seeing them again.

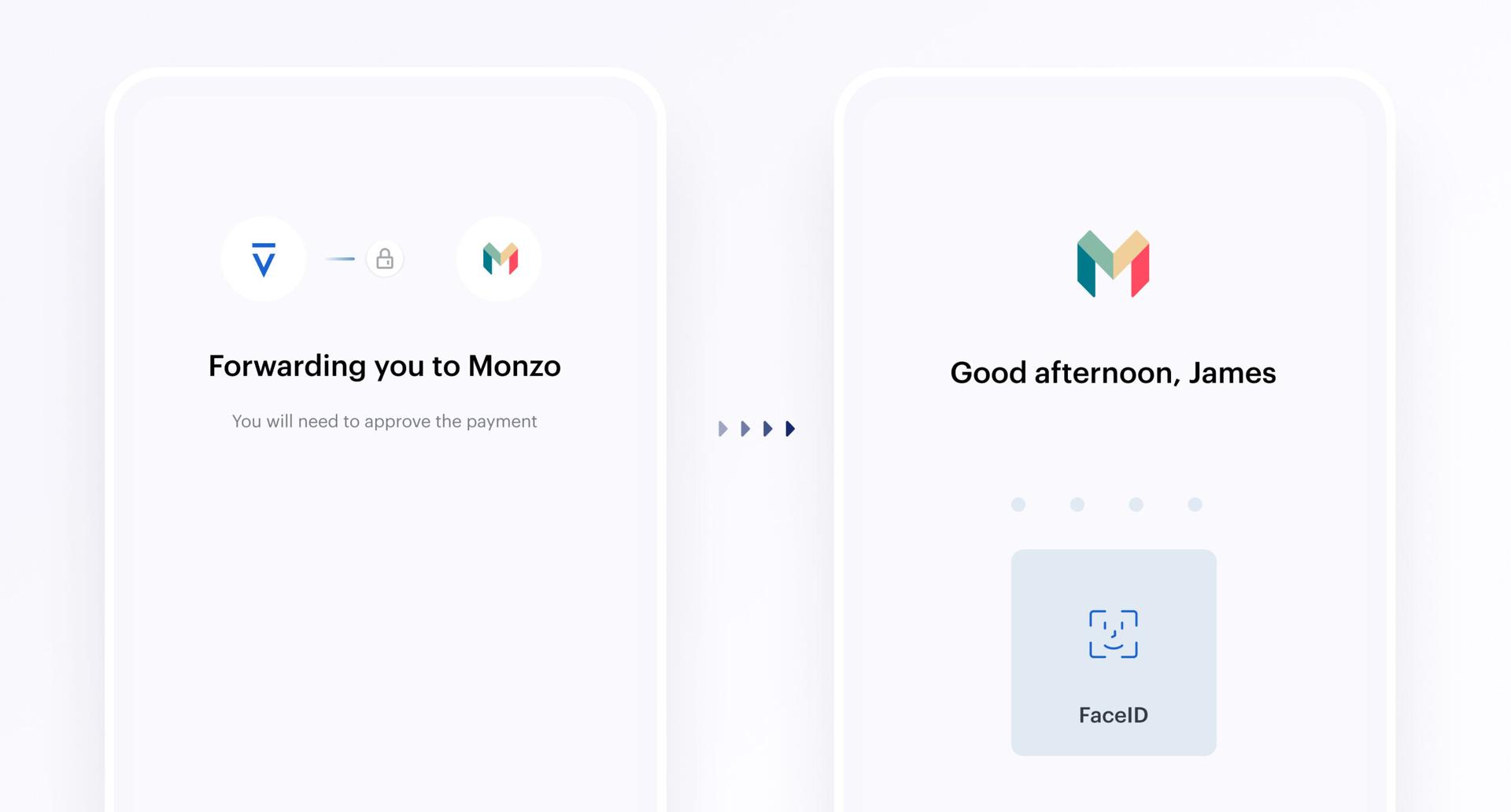

Let’s look at what happens when a shopper responds to the prompt. After hitting ‘Tap to continue’, they’ll be forwarded to their banking app and asked to log in. (It’s worth highlighting that, by logging in to their bank, Strong Customer Authentication requirements are automatically met – another advantage over card payments.)

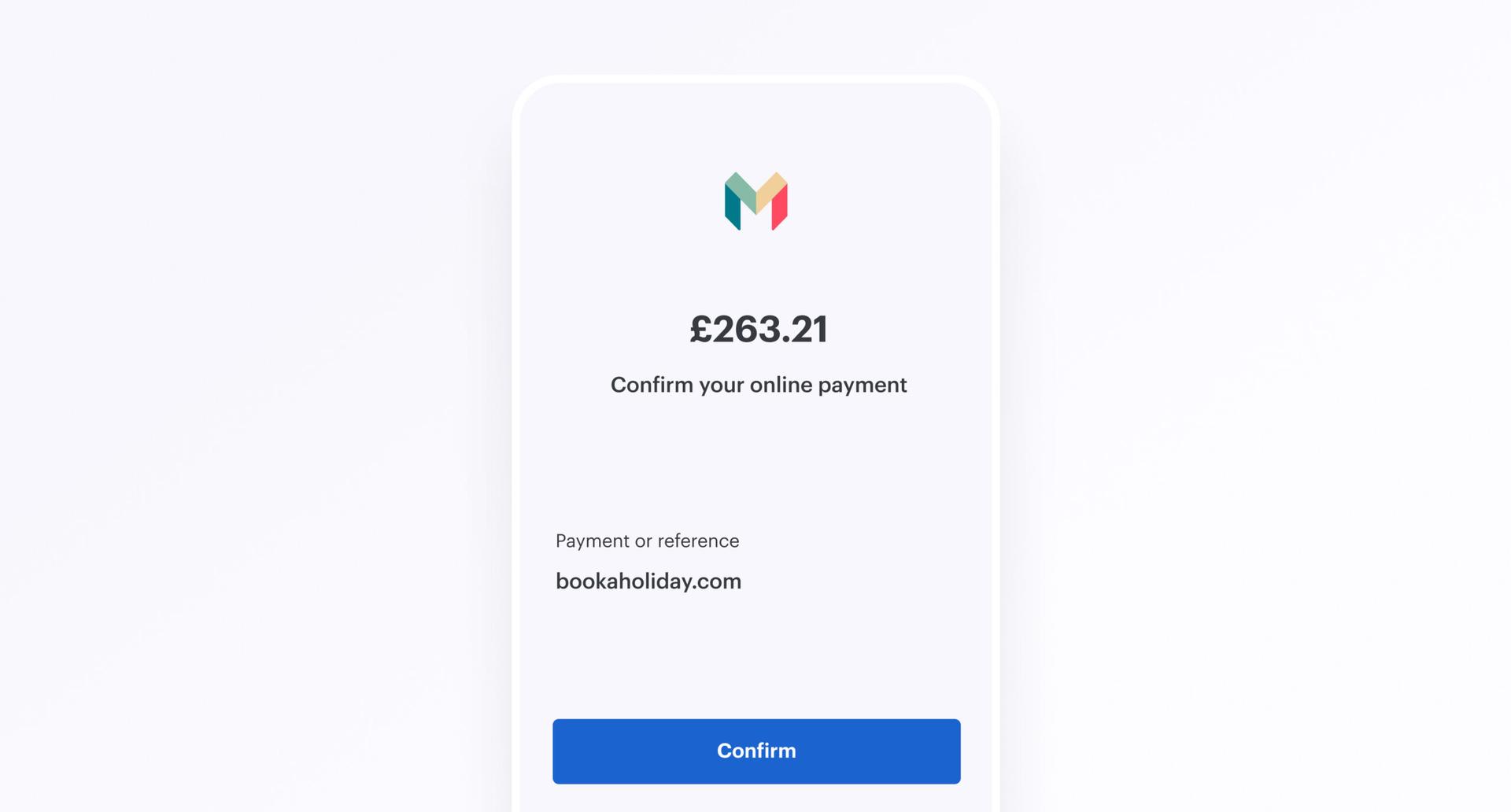

Once logged in, the customer sees the transaction ready for their approval. If they’re happy, they tap ‘Confirm’ to initiate the payment.

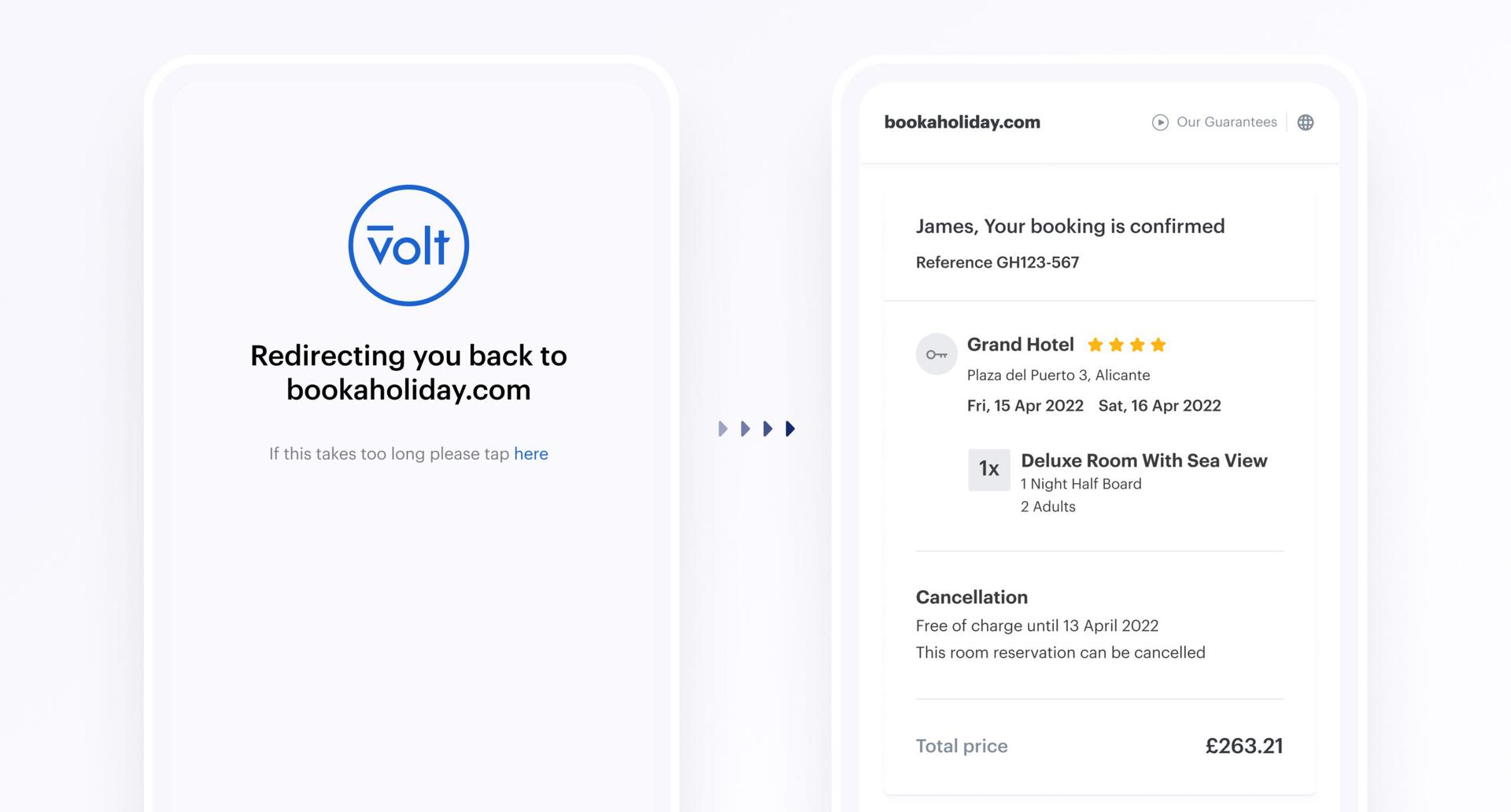

When the payment is completed, the customer is redirected to the merchant’s confirmation screen. Their booking is complete. Their reward points are earned. And, next time they book, they’ll be more likely to select ‘Pay from your bank account’ when it’s presented at the beginning.

We’ve given an OTA use case here, but Transformer is designed for any online business that wants to start shifting away from costly card payments via powerful customer incentives. Airlines, retailers, streaming services, car dealerships, events companies – they’re all suitable. The beauty of Transformer is that merchants are free to create their own incentives – from reward points and discounts to priority access and freebies.

It’s safe to say that the Volt team is hugely excited by Transformer’s potential, and that this excitement is shared by our customers. If it’s piqued your interest then we’d be happy to arrange a demo. Likewise, if you have any questions about how Transformer works, we’d be delighted to hear from you.

More like this

Open banking

Industry deep dive: Exploring player behaviour trends in eGaming

We uncover the latest player habits shaping the eGaming landscape, and how open banking delivers on the demand for superior in-game payment processes.

Open banking

How much are card fees: A complete guide to processing costs

From interchange fees to scheme costs, we explore the full set of expenses that come with accepting card payments - and how they can be avoided through open banking.

Market insights

How PayTo compares to other payment methods in Australia

Explore the advantages of PayTo over other payment methods in Australia when it comes to fees, transaction speed, security, and user experience.