Payment innovation

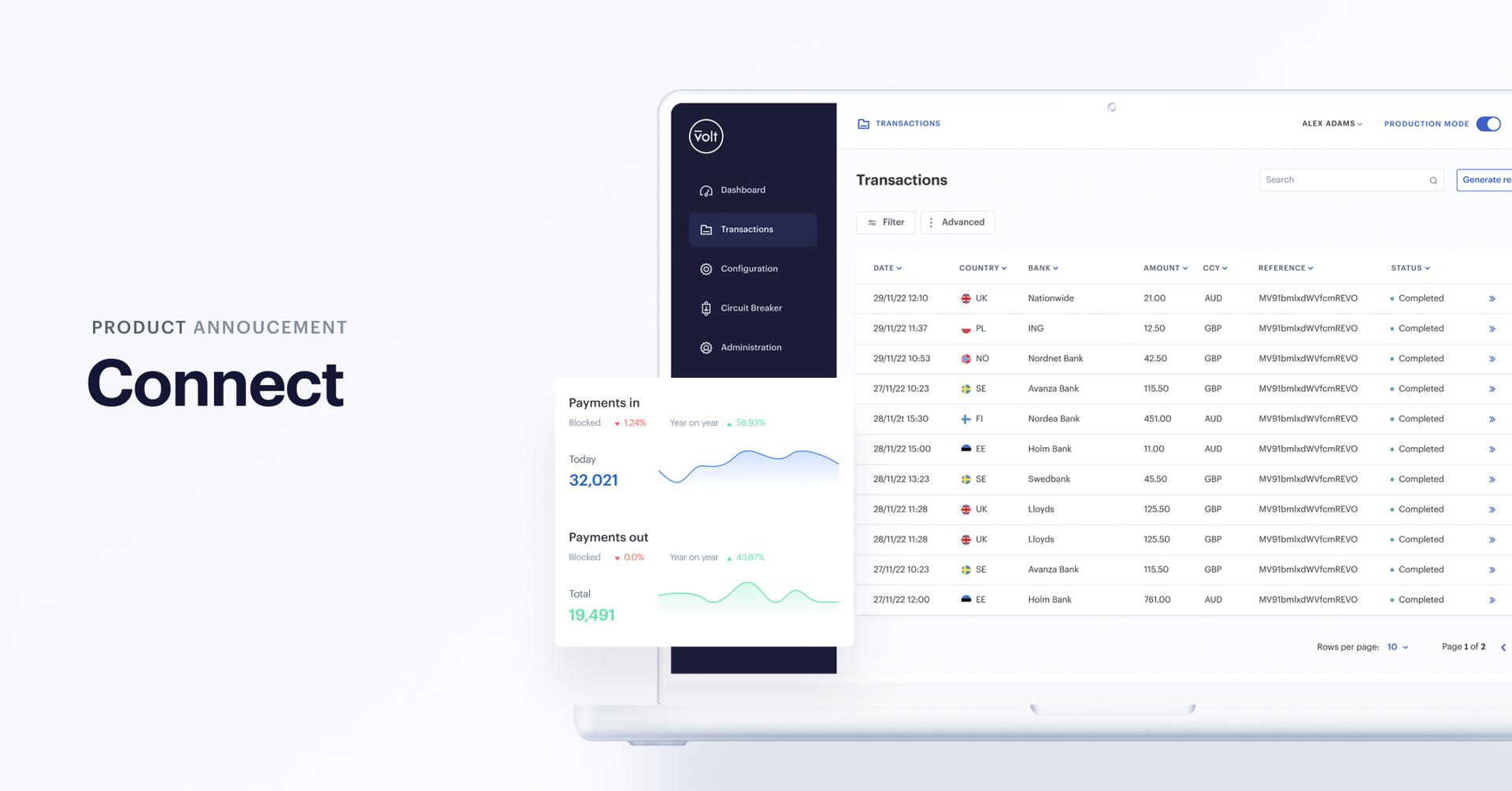

Volt launches end-to-end Cash Management

London, 28 April 2021: Volt, the leading open payments gateway, today unveiled new cash management functionality providing merchants and payment service providers (PSPs) with complete visibility of open banking payments made through the UK's Faster Payments Service and the European SEPA Credit Transfer and SEPA Instant Credit Transfer schemes.

Available in the UK now and across Europe by the end of May 2021, Volt Connect puts merchants in greater control of their cash by enabling them to track multi-currency PSD2 payments from the point of initiation to the moment of arrival in their accounts. Automatic reconciliation and reporting provide recipients with instant notification of settlement, allowing them to credit the correct customer account faster.

Tom Greenwood, CEO at Volt, comments: “Although account-to-account payments can land in recipients' accounts within seconds of initiation, they follow a complex, multi-step process, and there is no guarantee of settlement until the money arrives. This challenge is exacerbated where banks aren't connected to instant payment schemes.”

“With Volt Connect, we’ve made it possible to make losses from failed transactions a thing of the past by providing total visibility and control throughout the payment journey, regardless of the route taken. Merchants can dispatch goods or credit customer accounts faster and with the certainty of knowing where funds are at all times, minimising the risk of being left out of pocket by reversed charges or payment failure.”

Volt Connect adds to the market-leading functionality available in Volt's open payments gateway, which provides seamless connectivity to open banking by standardising the PSD2 payment initiation API to a simple, single point of access. Volt offers multiple paths for payments between accounts at more than 4,500 banks in the UK and Europe, removing single point of failure and improving conversion by optimising payment routing with machine learning.

Hear more about Volt Connect from CTO Steffen Vollert, and CCO Jordan Lawrence.

With Volt Connect, we’ve made it possible to make losses from failed transactions a thing of the past by providing total visibility and control throughout the payment journey, regardless of the route taken. Merchants can dispatch goods or credit customer accounts faster and with the certainty of knowing where funds are at all times, minimising the risk of being left out of pocket by reversed charges or payment failure.

More like this

Open banking

Industry deep dive: Exploring player behaviour trends in eGaming

We uncover the latest player habits shaping the eGaming landscape, and how open banking delivers on the demand for superior in-game payment processes.

Open banking

How much are card fees: A complete guide to processing costs

From interchange fees to scheme costs, we explore the full set of expenses that come with accepting card payments - and how they can be avoided through open banking.

Market insights

How PayTo compares to other payment methods in Australia

Explore the advantages of PayTo over other payment methods in Australia when it comes to fees, transaction speed, security, and user experience.