A better way to invest

and move money

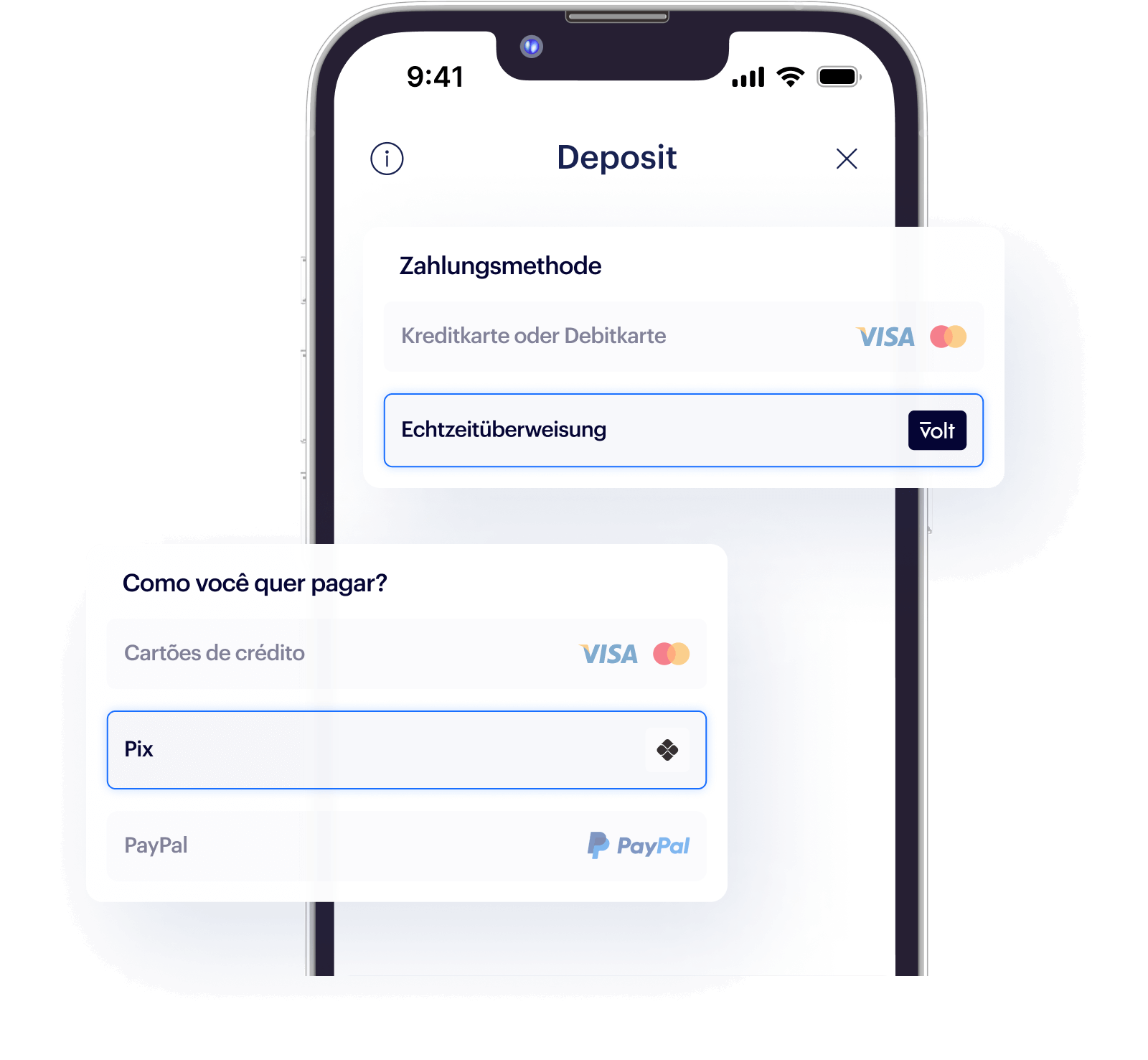

Give your customers the power to deposit funds or send

money, direct from their bank account. Globally.

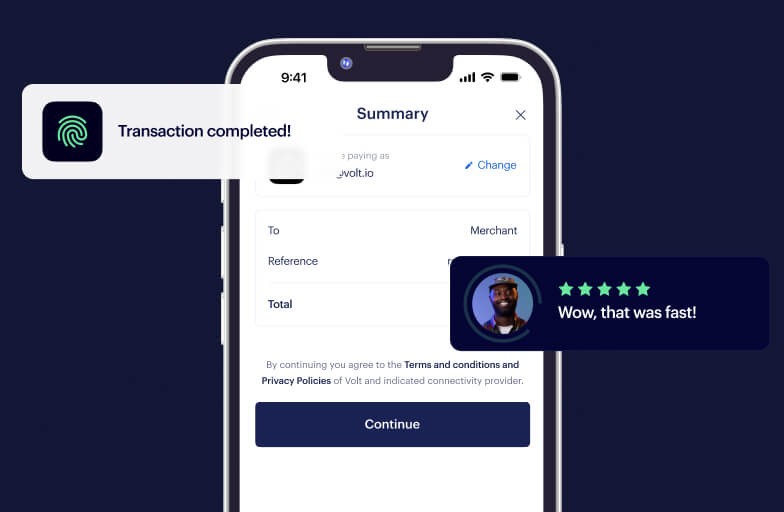

INSTANT BANK TRANSFERS

Powering frictionless

money movement

From facilitating frictionless deposits to powering super-fast remittances, Instant Bank Transfers work in the same seamless way across use cases.

Users simply choose their bank and pay from their bank account, where the transaction is pre-populated and ready to approve. Easy. Fast. Secure.

ONE INTEGRATION

Easy access to

multiple markets

A single integration enables you to process real-time pay-ins and payouts, and maintain full payment lifecycle visibility, across our global payments network.

We’re live across Europe, the UK, Brazil and Australia, meaning you can offer users everywhere a unified Instant Bank Transfer experience.

who we serve

Catering to money movement

and investment platforms

Solutions laser-focused on consumer-facing wealthtechs.

Investment platforms

Give users instant access to investment

opportunities and a faster, frictionless payments UX.

Trading platforms

CFD and FX trading platforms are perfectly

positioned to switch on the same key benefits.

Remittance platforms

Enable a quicker, easier and more secure way to pay

for cross-border remittances.

KEY BENEFITS

What wealthtech platforms can expect

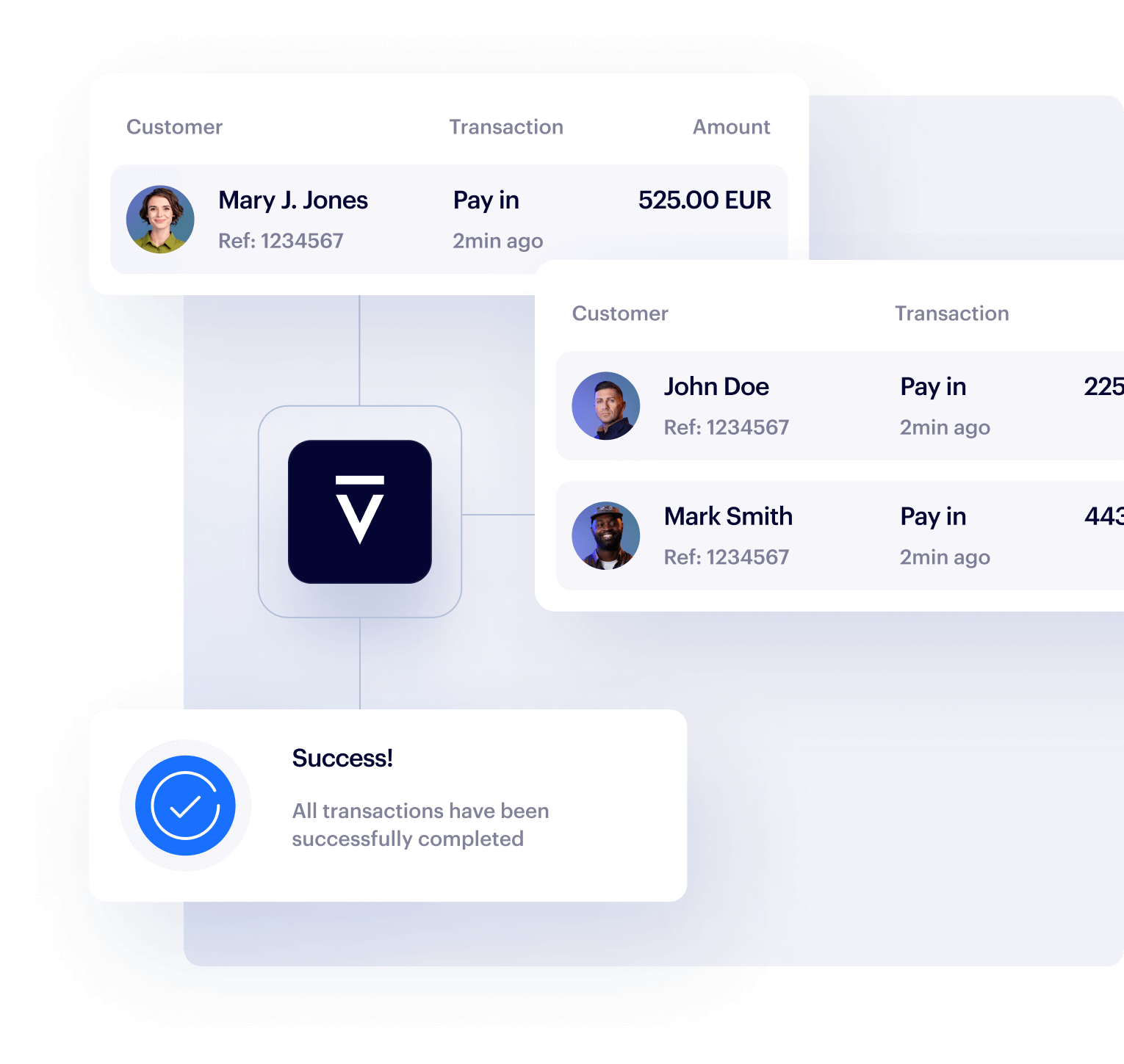

Instant pay-ins

and payouts

Because we’re plugged into multiple domestic next-gen payment networks, user deposits and payouts settle instantly. No matter where they are.

Accelerated

cashflow

From centralising your real-time payments with a Volt Account to issuing Virtual IBANs to your customers, we help you accelerate and optimise cash flows.

Improved

conversion

Instant Bank Transfers drive conversion by making payments faster, easier and more secure. Within wealthtech, they’ve become a customer expectation.

Peace of

mind

With multiple connections to 1,900+ banks around the world, we offer comprehensive connectivity and, should something go wrong, built-in redundancy.

WHAt SETS US APART

The Volt value-add

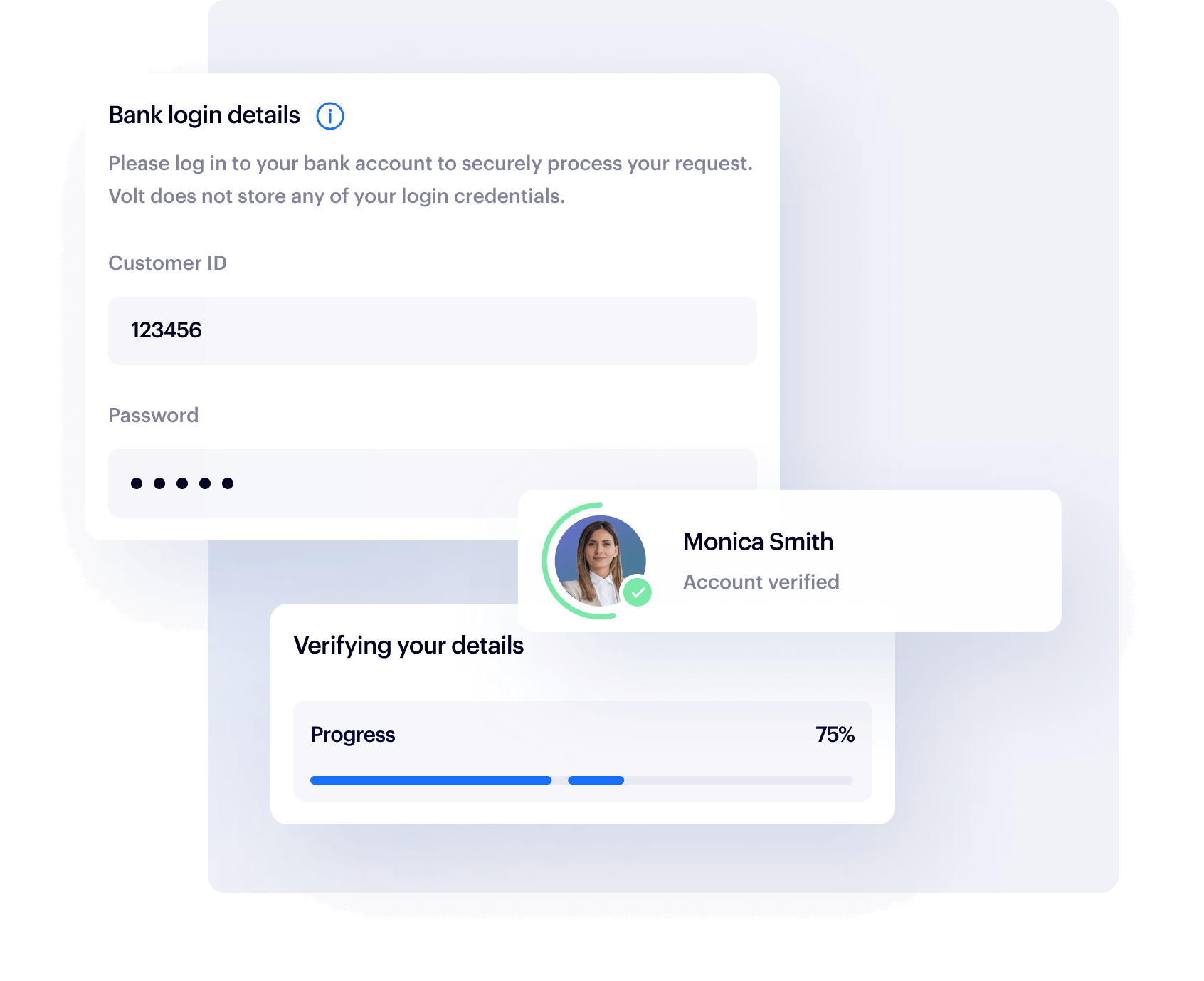

VERIFY

Easily authenticate new users

With Verify, you can confirm new users’ names and account numbers via secure access to their bank account. It’s a faster, more efficient way of verifying their core credentials.

CIRCUIT BREAKER

Intelligently prevent fraud

Proactively prevent fraud attacks. With Circuit Breaker, you can set rules tailored to your needs, governing transaction amount and volume, to reduce the risk of fraudulent transactions.

VIRTUAL IBANS

Manage incoming deposits at scale

No more manual reconciliations. By assigning unique Virtual IBANs to each of your customers, you can instantly identify incoming payments and match them to specific users.

OUR wealthtecH EXPERT

Watch: Why Instant Bank Transfers are a must for wealthtech platforms

VOLT FOR WEALTHTECH PLATFORMS

Our capabilities: At a glance

An overview our wealthtech-specific product suite.

Instant deposits

Accept instant pay-ins via a best-in-class checkout, globally. Optimised UX.

Instant payouts

Initiate instant payouts to users. Grant on-demand access to returns.

Cash management

Gain full visibility and control over all balances and transactions.

Instant reconciliations

Issue Virtual IBANs to instantly match pay-ins to specific users.

User verification

Verify new users’ names and account numbers with our AIS tool.

Fraud prevention

Detect and prevent fraudulent transactions with tailored risk rules.

INTEGRATION OPTIONS